One of the key things to decide when starting a business in Singapore is the form that the business will take. There are 3 common types of business structures - Sole proprietorship, Partnership and Private limited company.

We compare two popular choices below: Sole proprietorship and Private limited company.

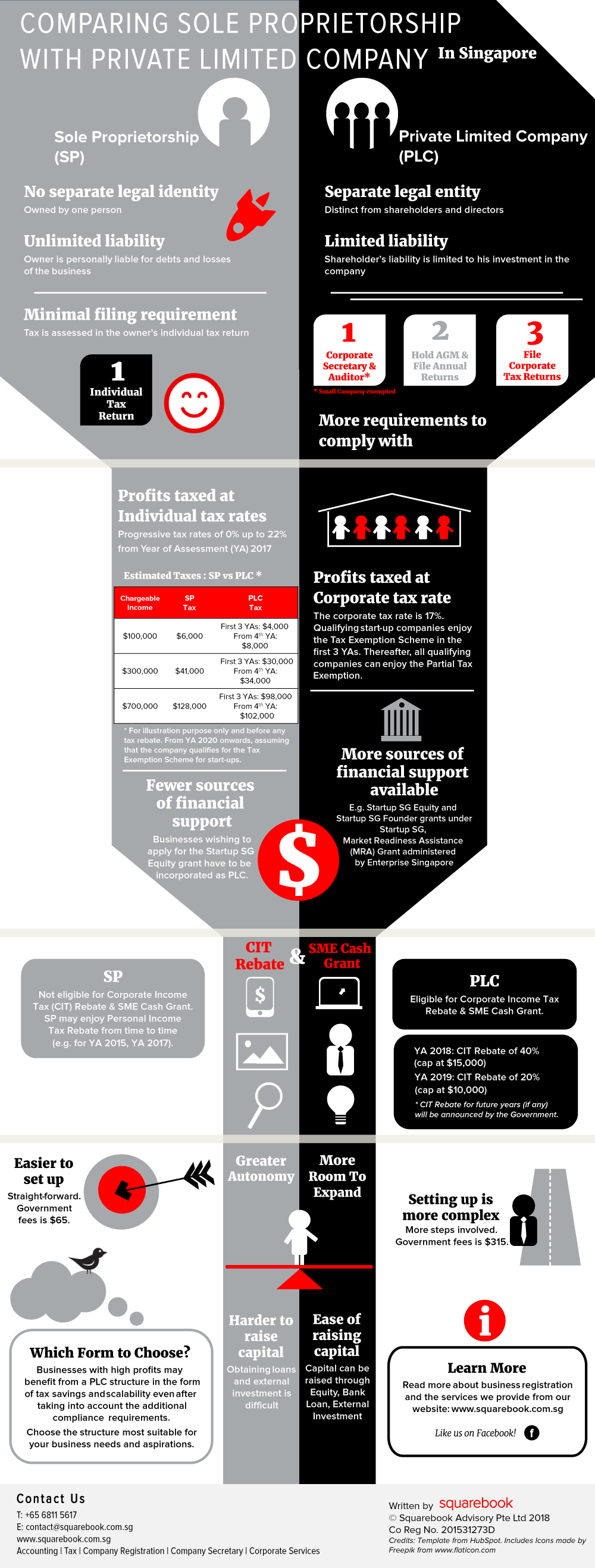

1) Legal identity & Liability

A Sole proprietorship is owned by the sole proprietor and has no separate legal identity of its own. The sole proprietor (owner) is personally liable for debts and losses of the business.

Whereas a Private limited company is a separate legal entity that is distinct from its shareholders and directors. In this case, shareholders are not personally liable for company debts and liability of a shareholder is limited to his investment in the company.

2) Statutory requirements

Sole proprietorship has minimal filing requirements. Income tax on the business is assessed in the sole proprietor’s personal tax return.

Private limited company has more compliance requirements to meet which include having to appoint a Company Secretary, hold Annual General Meeting (AGM) and file its Annual Returns (AR) with ACRA. A private limited company that does not fall within the ‘small company’ criteria will need to appoint an auditor.

The income tax on the business is also assessed in the corporate tax returns of the Private limited company.

To get a clearer picture of the compliance requirements of a Private limited company, have a look at The Compliance Timeline [Infographic].

3) Income tax

Profits of a Sole proprietorship are taxed at individual tax rates. For sole proprietors that are Singapore tax residents, progressive tax rates of 0% up to 22% will apply from Year of Assessment 2017 onwards.

For a Private limited company, profits are taxed at corporate tax rate. The prevailing corporate tax rate is 17%. Qualifying start-up Private limited company enjoys the Tax Exemption Scheme in the first 3 Years of Assessment. From YA 2020 onwards, $125,000 out of the first $200,000 of chargeable income is exempted.

From the 4th Year of Assessment onwards, from YA 2020, Private limited company can enjoy the Partial Tax Exemption where $102,500 out of the first $200,000 chargeable income is exempted.

Generally, qualifying start-up Private limited company benefits during the first 3 Years of Assessments as it enjoys significant tax exemption. This tax exemption scheme does not extend to Sole proprietorship which pays higher taxes during this period.

4) Financial support

Generally, there are more sources of financial support available to Private limited company than to Sole proprietorship. Examples of grants available to Private limited company include Startup SG Equity, Startup SG Founder and Market Readiness Assistance (MRA) grant.

Businesses wishing to obtain the Startup SG Equity grant will have to be incorporated as Private limited company, while applications for MRA grant made by Sole proprietorship will be assessed on a case-by-case basis.

5) Corporate Income Tax (CIT) Rebate & SME Cash Grant

Sole proprietorship is not eligible for CIT Rebate and SME Cash Grant. However, Sole proprietorship may be able to enjoy personal income tax rebate from time to time when granted by the Government (e.g. for YA 2015, YA 2017).

On the other hand, Private limited company are eligible for CIT Rebate and SME Cash Grant when they are announced by the Government. For YA 2018, CIT Rebate is 40%, capped at $15,000. For YA 2019, CIT Rebate is 20%, capped at $10,000. CIT Rebate for future years (if any) will be announced by the Government. CIT Rebate is reflected in the company's income tax computation and assessment.

6) Freedom

A Sole proprietorship being the sole owner of the business has greater autonomy.

Directors of Private limited company owe fiduciary duties to the company and its shareholders. However a Private limited company can scale and expand its business more easily.

7) Setting up

Registering a Sole proprietorship is more straight-forward, with government fees of $65.

Setting up a Private limited company involves more steps and considerations and is more complex. Government fee for registering a Private limited company is $315.

8) Raising capital

Obtaining loans and external investment is more difficult for Sole proprietorship as the business is tied to the owner personally. Private limited company can raise capital more easily through bank loans, issuing equity and external investments.

Which form to choose?

Generally, Sole proprietorship may be suitable for small businesses with little risks.

A Private limited company needs to comply with more requirements as compared to a Sole proprietorship. In turn, however, a Private limited company provides advantages over a Sole proprietorship in terms of tax savings, better protection of assets and scalability.

Commonly, grant institutions may also regard Private limited companies more favourably as Private limited companies comply with more rigorous requirements, lending themselves to greater accountability.

These benefits are accentuated especially when the business generates high profits and is expanding its operations.

Looking to start a business?

Our company incorporation services are designed to deliver good value and take care of your company's incorporation requirements.

If you’re looking to expand and plan to convert your Sole proprietorship to a Private limited company, we can assist you with the conversion.

How we help

Company incorporation package

Company incorporation package

Company name application

Company incorporation

12-months company secretary

ACRA Incorporation fees

ACRA Company Business Profile & Constitution

E-Notice of Incorporation

Share certificates

First Directors' Resolutions

Official common seal

Self-inking rubber stamp

Corporate bank account opening assistance

Meet compliance

Meet compliance

Comply with the Companies Act.

Get in touch

Get in touch to incorporate your company. Or if you've a question, drop us a note.